Key Takeaways:

- Understanding Different Budgeting Methods: This article provides an in-depth look at various budgeting techniques, helping you find the one that fits your financial style and goals.

- Benefits of Budgeting: Discover how each budgeting method can help you gain financial control, save more, and reduce stress.

- Practical Tips and Tricks: Alongside each budgeting type, we offer practical advice on how to implement these strategies effectively in your daily life.

- Adapting Budgeting to Life Changes: Learn how different budgeting methods can be adapted to various life stages and financial situations.

Have you ever felt like managing your finances is a juggling act? You’re not alone! In the dynamic world of personal finance, budgeting stands as a beacon of order and planning. But with so many types of budgeting methods out there, how do you know which one is right for you? In this article, we’ll dive into the different types of budgeting, offering a friendly guide to help you navigate these waters.

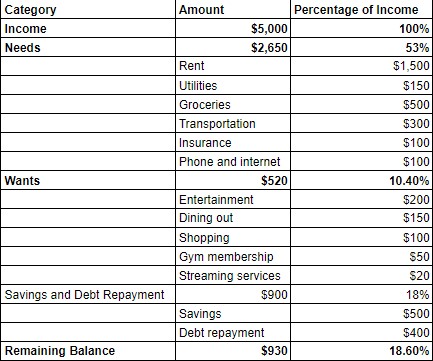

1. The Traditional Budget – Oldie but Goldie

Let’s start with the traditional budget, the grandfather of all budgeting methods. It’s straightforward: list your income, subtract your expenses, and voila! You know exactly how much you can spend and save. While it might not be flashy, it’s reliable and perfect for those who appreciate simplicity and a clear structure. See the example of a traditional budget below:

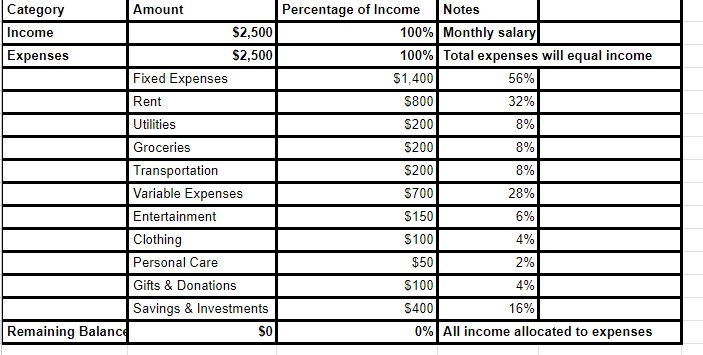

2. Zero-Based Budgeting – Every Dollar Has a Job

Imagine giving every dollar you earn to a specific job. That’s zero-based budgeting in a nutshell. It’s a proactive approach where you allocate every penny of your income to specific expenses, savings, or debt payments. It’s perfect for detail-oriented planners who enjoy having a place for everything and everything in its place.

3. The 50/30/20 Rule – Balancing Act

The 50/30/20 rule simplifies budgeting into three categories: 50% of your income goes to needs, 30% to wants, and 20% to savings or debt repayment. It’s like having a financial diet where you balance your ‘nutritional’ intake. Ideal for those who want a flexible but structured approach to budgeting. See example below:

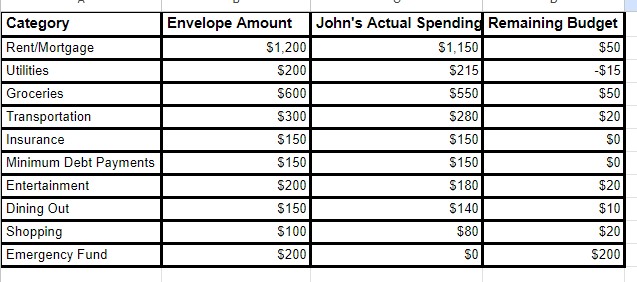

4. Envelope System – Cash is King

This method involves dividing your cash into envelopes labeled for different expenses. Once an envelope is empty, that’s it for the month. It’s a tangible, hands-on approach that really makes you think about each dollar. Great for those who need a physical reminder to curb spending. See example below:

5. Apps and Digital Tools – Budgeting in the Digital Age

In an era where there’s an app for everything, budgeting apps like Mint, YNAB (You Need A Budget), and others offer a modern take on budgeting. They link to your bank accounts, track your spending, and even offer personalized financial advice. Perfect for the tech-savvy and those always on the go.

6. The Pay-Yourself-First Budget – Savings First, Spend Later

Instead of budgeting your expenses first, this method focuses on saving a set amount of your income first and then spending the remainder. It flips traditional budgeting on its head and is fantastic for building your savings effortlessly. See the example of pay yourself first budget below:

7. Value-Based Budgeting – Aligning Money and Values

This approach is less about the numbers and more about your personal values and goals. It involves prioritizing spending on things that bring you joy and fulfillment while cutting back on less meaningful expenses. Ideal for those seeking a budget that reflects their lifestyle and values. See the example of value-based budgeting below:

8. The Kakeibo Method – Mindful Budgeting from Japan

Kakeibo, a Japanese method, emphasizes careful and mindful spending. It involves journaling your income and expenses in four categories, Income, expenses, wants vs needs, and reflections. It’s a contemplative approach that encourages you to think deeply about your relationship with money. Here’s an example of how the Kakeibo method might look in practice:

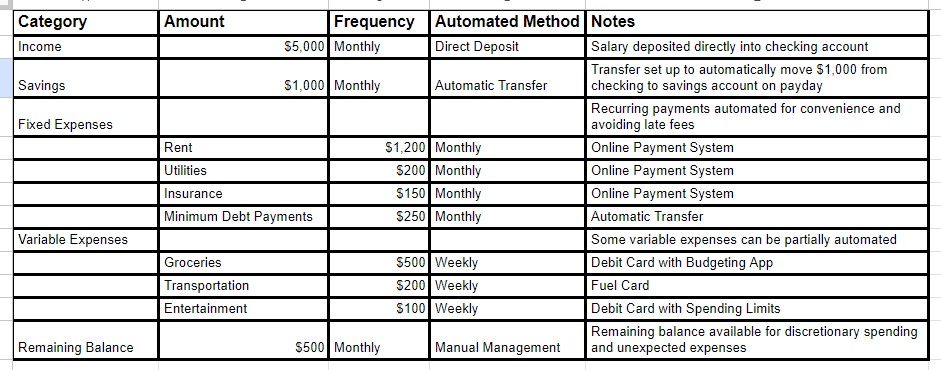

9. The Automated Budget – Set It and Forget It

Automated budgeting involves setting up automatic transfers for bills, savings, and investments as soon as your paycheck arrives. It’s a ‘hands-off’ approach that’s perfect for those who want to make their financial planning as effortless as possible. Here’s an example of how the Automated budgeting method might look in practice:

10. Hybrid Budgeting – Best of Both Worlds

Why stick to one method when you can mix and match? Hybrid budgeting allows you to combine elements of different methods to create a custom plan that suits your unique financial situation. It allows you to benefit from the strengths of various methods while minimizing their weaknesses. Below is an example of combining the strengths of 3 types of budgeting methods to benefit from the advantages and minimize the disadvantages.

Conclusion

Budgeting is not a one-size-fits-all affair. It’s a personal journey where the best method is the one that aligns with your lifestyle, goals, and financial situation. Whether you’re a meticulous planner or a free spirit, there’s a budgeting style out there for you. Embrace the process, experiment with different methods, and watch as your financial confidence grows. Happy budgeting!